Gold prices edged up slightly in Asian trading on Monday, recovering some of the losses from the previous week as traders remained cautious ahead of a crucial U.S. inflation reading expected later this week.

Trading volumes were generally subdued due to market holidays in the UK and the U.S., and anticipation surrounding U.S. interest rate cues also deterred significant market movements.

In the industrial metals sector, copper prices also saw an uptick, rebounding after a sharp decline from record highs last week.

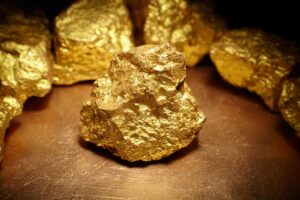

Spot gold increased by 0.4% to $2,343.23 per ounce, while gold futures for June delivery also rose by 0.4% to $2,344.10 per ounce as of 00:33 ET (04:33 GMT). Spot prices are still recovering from their recent tumble from record highs.

PCE Test Looms as Waning Rate Cut Bets Pressure Gold

This week, the focus is on the Personal Consumption Expenditures (PCE) price index data, the Federal Reserve’s preferred measure of inflation, due on Friday.

Following a series of warnings from Fed officials about persistent inflation, traders have largely dismissed the likelihood of rate cuts by the central bank this year. According to the CME FedWatch tool, traders now see a higher probability that the Fed will maintain current rates in September, which was initially seen as the most likely timing for a rate cut.

This shift in expectations has pressured gold and broader metal prices in recent weeks, with traders showing a stronger preference for the dollar and Treasuries.

The diminished demand for gold as a safe haven has also weighed on its prices.

Other precious metals rose on Monday, recovering from last week’s losses as well. Platinum futures climbed 1.2% to $1,048.70 per ounce, while silver futures increased by 1.7% to $31.023 per ounce.

Copper Prices Steady After Last Week’s Plunge

One-month copper futures rose by 0.3% to $4.7720 per pound, as the speculative frenzy that drove prices to record highs in May has now calmed down.

Attention is now focused on whether the physical copper markets are as tight as initially speculated and whether supply will remain steady in the coming months.

Markets are also awaiting further signals from China, the top copper importer, particularly regarding how Beijing plans to fund and implement a series of recently announced stimulus measures.

.

#everyday_information #forex #option #Binary_Option #trading #trader #goldstocks #forextrader #fx_trade_time #fxttime #USDollar #euro #JPY #GBP #chfcurrency

#dubai #UAENews #ksasaudiarabia #Syrian #iraq #kuwait #jordan #morocco #Libya #tunisia #algerian #Egypt #qatar #lebanon

#كل_يوم_معلومه #فوركس #خيارات_ثنائيه #تداول_عملات #بورصه #ذهب #فوركس_تريد_تايم #اف_اكس_تريد_تايم #دولار #يورو

#دبي #امارات #السعوديه #سوريا #العراق #الكويت #الاردن #المغرب #ليبيا #تونس #الجزائر #مصر #قطر #لبنان

.

www.fxttime.com/trade